Increase your KiwiSaver portfolio with three simple decisions

By Ben Brinkerhoff | Head of Adviser Services, Consilium

What if all the money you need for a good retirement was available via KiwiSaver?

To have this sort of financial security, those investors blessed with time need to get only three key KiwiSaver decisions right. Sadly, in my experience very few do.

So, what are those key decisions?

- How much to save

- What allocation to use

- When to retire

In order to analyse the impact of these decisions we need to first establish a baseline of key assumptions. As a base, let’s look at an investor with the following characteristics:

- Age: 25

- Starting value: $0

- Current Salary: $50,000 increasing 3% per year (based on wage inflation over the past year or so)

- Employer contribution: 3%

- Employee contribution: 3%

- Government contribution: $521

- Employee Superannuation Contribution Tax: 33%

- Portfolio: Defensive (1.5% net return)

Applying all these we get a KiwiSaver balance of approximately $282,837 at age 65. But is that enough?

Recently, my company, Consilium, along with Financial Advice New Zealand, sponsored a Massey University report entitled ‘New Zealand Retirement Expenditure Guidelines 2021.’ According to that report, a single person in a metropolitan area would need about $600,000 if retiring today to ensure a “Choices” rather than a “No Frills” retirement. (think of Choices as a comfortable retirement with some luxuries, No Frills as a basic lifestyle).

Given our baseline investor is 25 and will invest for 40 years, we inflate that $600,000 by an estimated inflation rate of 2% a year for 40 years. That gives our investor a target retirement target balance of about $1,325,000 at age 65. Which is well short of the baseline KiwiSaver balance of $282,837.

To close the gap, let’s apply our key KiwiSaver decisions one at a time to determine the impact each one has.

Decision 1: How much to save?

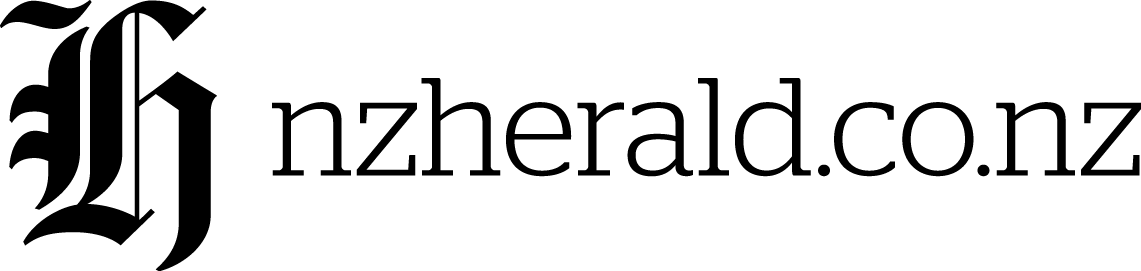

Let’s take the different KiwiSaver contribution rates and see what impact they have on the portfolio value at age 65:

Taken simply by themselves, without changing anything else, you can see that increasing the savings rate to 10% will increase your balance by 125%.

But even the $637,193 of savings achieved at that rate still isn’t enough to achieve that Choices metro retirement level.

Which takes us to decision 2.

Decision 2: What allocation to use?

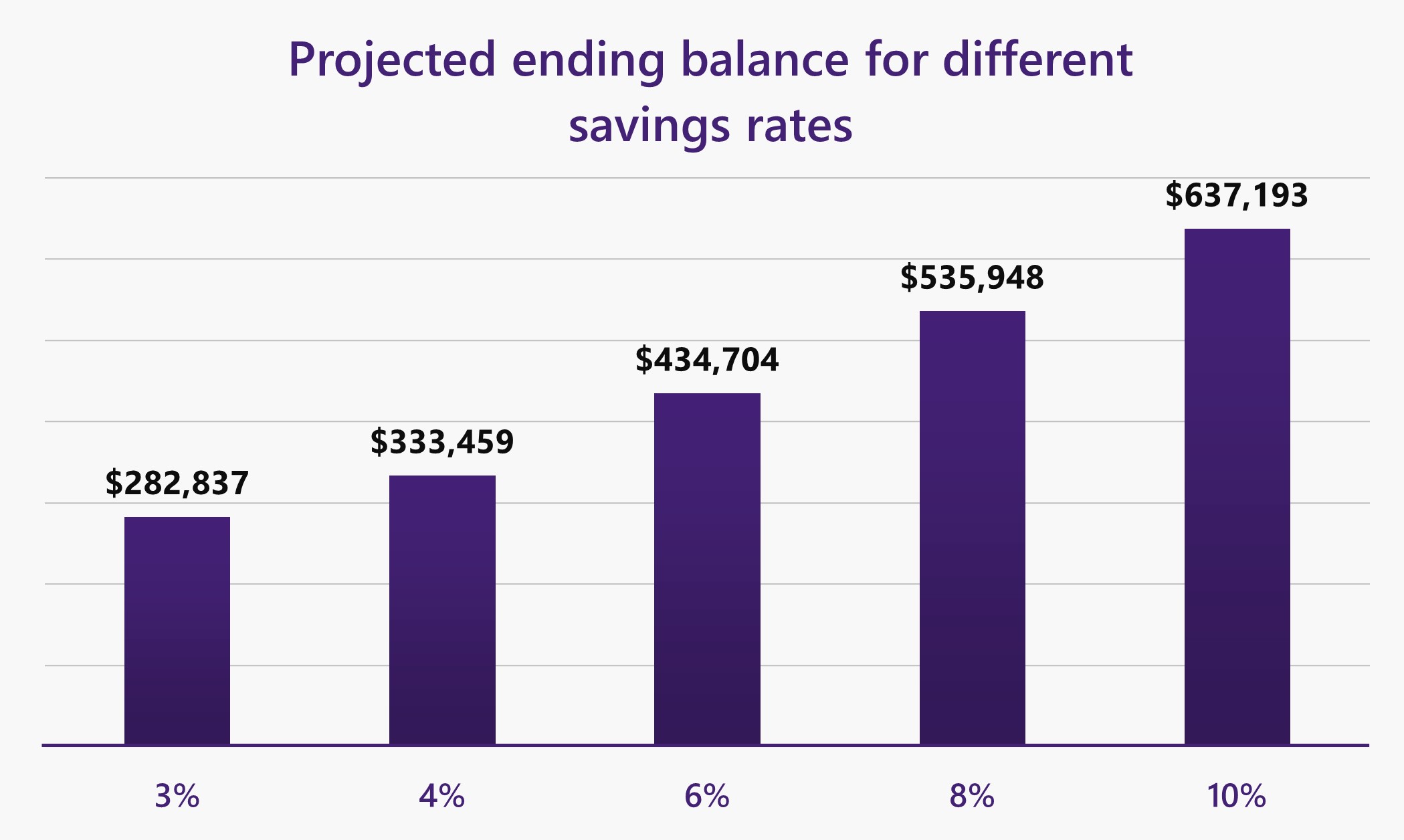

Using the Financial Markets Authority’s assumed rates of return for KiwiSaver return projections after taxes and fees – Defensive at 1.5%, Conservative 2.5%, Balanced 3.5%, Growth 4.5% and Aggressive 5.5% - we calculated the value of each of those portfolios at age 65 and the increase over the default.

Holding all other decisions constant, you can see the impact of each allocation:

What a huge difference simply ticking a box can make. Though an Aggressive portfolio will experience more up and down movements than the others, history shows it also grows wealth much faster.

But merely being an aggressive investor still leaves us well short of our inflation-adjusted target of $1,325,000 to achieve a Choices retirement.

Which brings us to decision 3.

Decision 3: When to retire

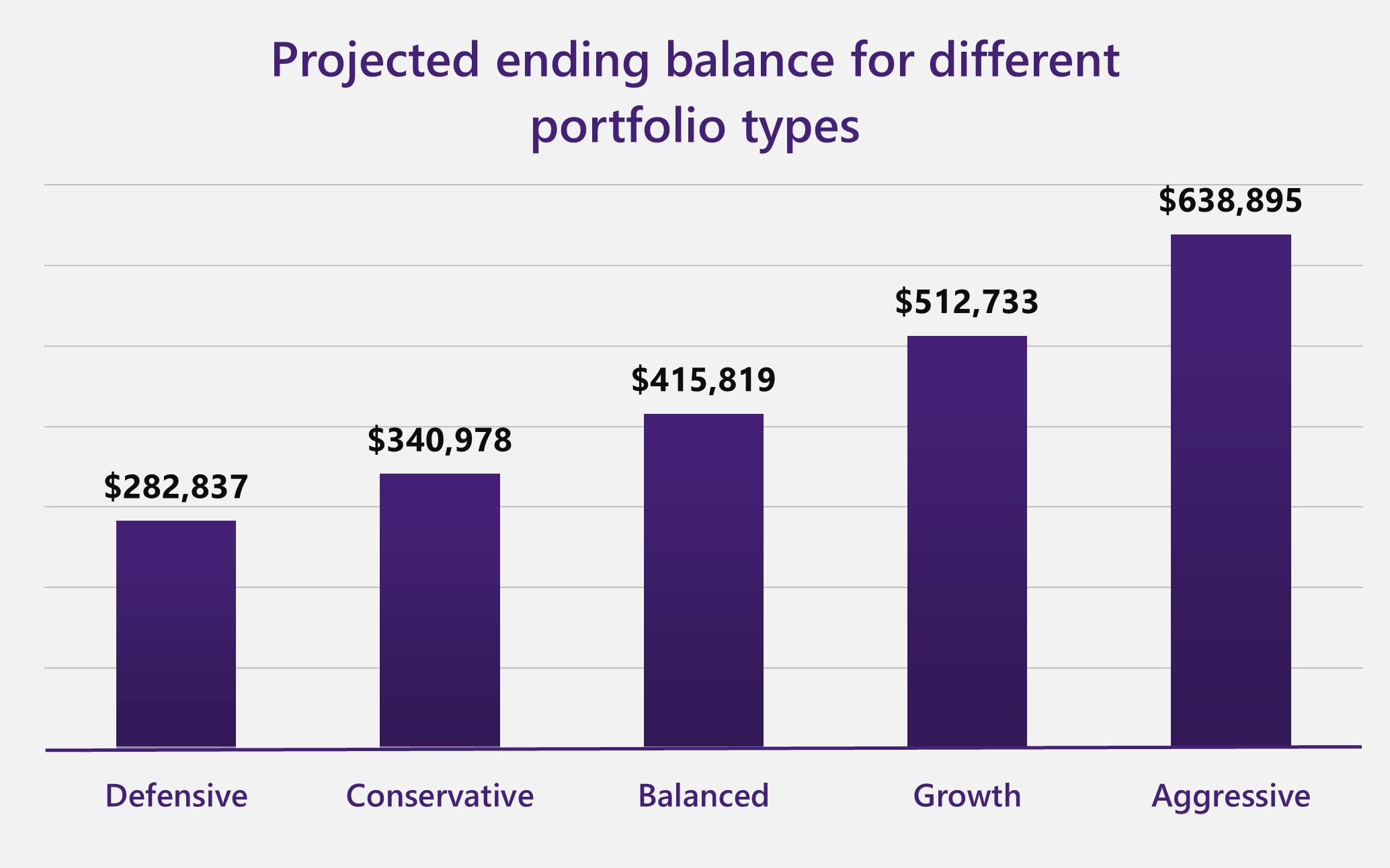

More and more investors want to continue working past 65 and, as it turns out, doing so can make a difference to your KiwiSaver balance.

You cannot access your money until 65, but what if you stopped working (and stopped making deposits) at 60 or kept working a further five years or even 10 years past 65?

This graph shows doing this has a significant impact:

But clearly, working longer has less impact than investing more aggressively or saving more. (I acknowledge if you work longer, you start spending later, and those two effects will increase the impact).

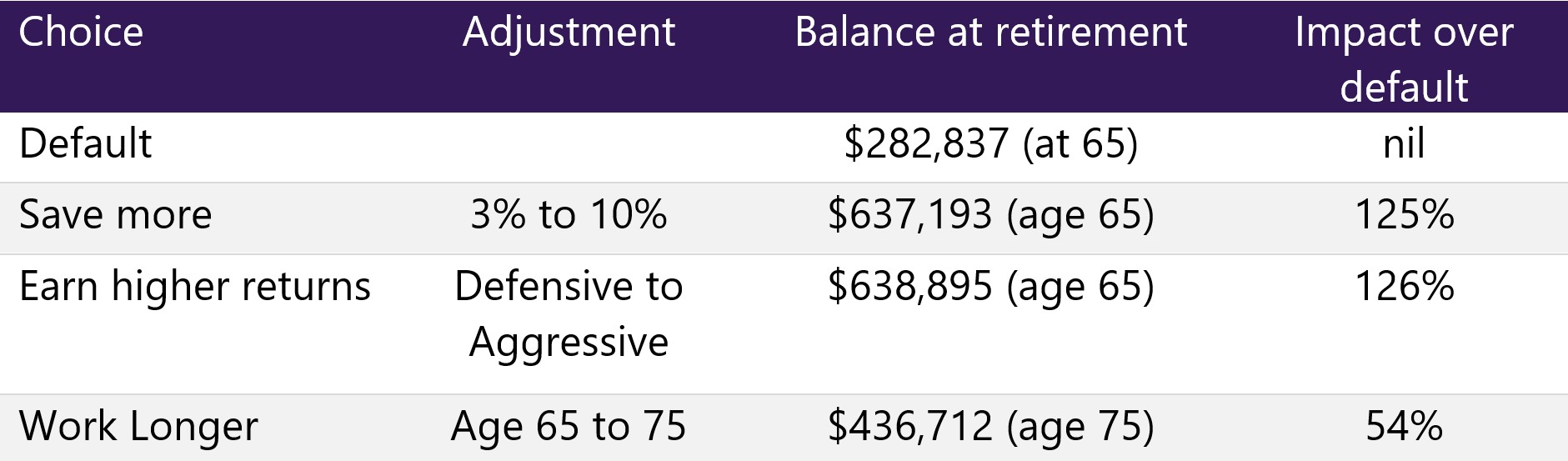

Impact summary

Let’s look at these three choices together to see their relative impact:

What about a combination?

The analysis above shows none of our scenarios by themselves is enough to reach the target for a Choices lifestyle. But what if we combine them?

Let's say you save 10%, invest aggressively, and work till 75. What do you think the pre-retirement portfolio would be worth? It's hard to believe, but the answer is approximately $2,736,344!

And it all looks pretty simple, especially when you remember it all comes on a modest salary of just $50,000 that goes up by 3% a year.

You just need the discipline, and that’s the hard part.

The other observation I would make is an ending balance of $2.7 million is much more than the Massey University guidelines recommend, so you could tweak that if you wanted.

For example, you could transition from an Aggressive fund to Growth after age 60 and from Growth to Balanced at 63 and you’d end up almost spot on our $1,325,000 target. Likewise, you could reduce contributions to 8% at age 50 and 6% at 56 and again end up almost spot on the $1,325,000.

There are many combinations of saving, investing, working and earning that would achieve the Massey target, and they get even better when you plan for a couple rather than an individual. And I haven’t mentioned the qualitative differences between KiwiSaver portfolios. Remember, not every growth portfolio is the same.

The point is, you can use any combination to suit your life preferences. You just need that discipline and maybe help from a professional adviser who can help guide you to make the best choices for your lifestyle and expectations.

It’s very clear from this exercise the key decisions of portfolio choice, savings rate, and when to retire can have significant impacts your fund at retirement. We’ve taken the same person earning the same amount over the course of their entire life, and we’ve gone from an ending balance of $282,837 to $2,736,344.

Same person! Same earnings! Three levers! 10X difference in retirement nest egg!

I believe this proves one crucial point – if you use KiwiSaver to its full potential, you have every chance of not needing any other savings vehicle in order to achieve financial freedom.

As published on NZ Herald — Opinion: Three ways to boost your KiwiSaver

3 January 2022