Investment portfolios

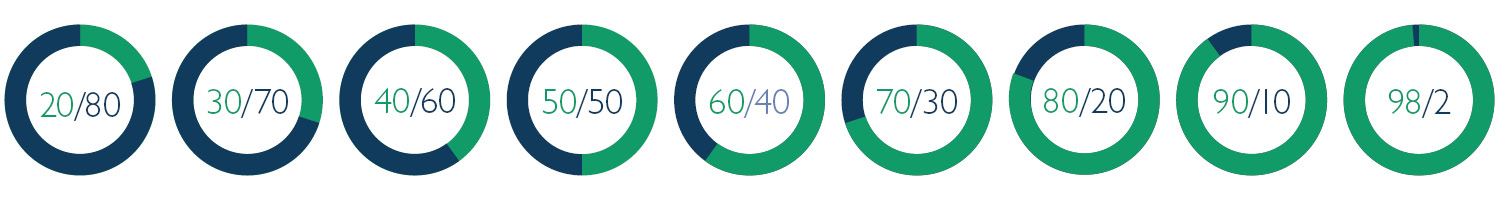

Consilium builds and maintains a range of model investment portfolios for investors working with partner firm advisers. This allows investors to be matched to an investment solution suitable to their specific risk capacity and investment preferences.

Investment portfolios

Portfolios are constructed following a strategic asset allocation process, where every allocation decision is subjected to a detailed review. All underlying investment recommendations are subject to a comprehensive quarterly monitoring process to ensure they are delivering consistent exposure to the desired risk factors to help maximise the investors’ risk adjusted returns.

Our portfolios offer risk levels ranging from very defensive (80% fixed interest) to very aggressive (pure equities) and include solutions that can cater to investors with a preference to invest with a Socially Responsible mandate.

A wide range of support is available including monitoring reports, analysis of historical performance of portfolios and underlying securities to expected risk and return characteristics to help in long term goal planning.

CONSILIUM PORTFOLIOS

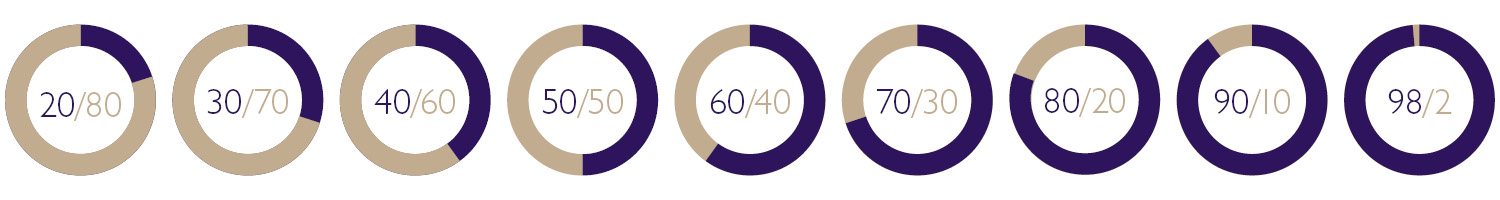

Socially responsible investing

Consilium offers a suite of portfolios that adopt a Socially Responsible Investment (SRI) mandate that place an emphasis on supporting higher levels of environmental and ethical sustainability, whilst remaining faithful to our evidence based investment philosophy.

To achieve this, we select funds from within our Approved Products List (that includes only investments that are low cost, widely diversified and non-speculative) that implement an SRI overlay.

Currently, we are able to invest in funds such that the SRI portfolios have no direct or indirect investments in companies with more than an incidental proportion of revenue generated by:

- The production, manufacturing or significant sales of tobacco

- The production, manufacturing or significant sales of controversial weapons

- The manufacturing of nuclear weapons

- The manufacturing of components developed or significantly modified for exclusive use in nuclear weapons

- Providing auxiliary services related to nuclear weapons

While the above represent minimum exclusions, most funds within the SRI portfolios will also take into account additional environmental and sustainability factors when considering their investments. Where applicable, these additional factors may include some, or all, of the following:

- Carbon and other greenhouse gas emissions or potential emissions

- Land use

- Biodiversity

- Involvement in toxic spills or releases

- Operational waste

- Water use

- Child labour

- Civilian firearms

- Alcohol

- Pornography

- Gambling

- Factory farming activities

CONSILIUM SRI PORTFOLIOS