Synergy

Powering Investment Portfolios

Synergy offers a variety of model investment portfolios to help investors reach their goals.

Through Synergy, selected financial advisers can offer a DIMS to suitable investor clients, without their firm having to hold its own licence. Advisers are responsible for the planning and advice, and Consilium is responsible for all operational and DIMS obligations, including regulatory documents, monitoring, rebalancing and reporting.

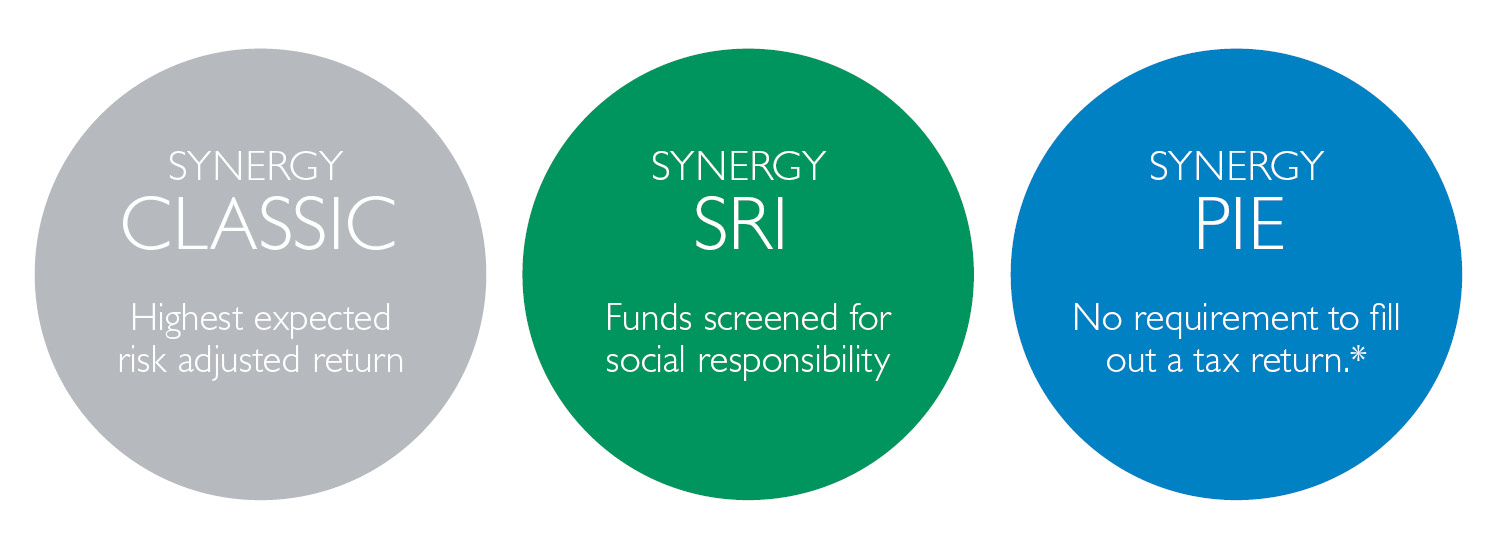

Investors in Synergy have access to 22 model portfolios, which include nine with an increased element of socially responsible investing (SRI) and four which consist of portfolio investment entity (PIE) funds only.

We optimise the portfolios, negotiate the costs, undertake the buying, selling and rebalancing, and give you regular reporting so you can enjoy convenience, confidence and peace of mind.

Synergy seeks to outperform standard market returns by utilising the best attributes of active and passive strategies.

Advisers using Synergy are supported by the Consilium business development and administration teams.

See the website for more information

Consilium Portfolios

The Consilium Investment Committee is responsible for investment research, portfolio construction, monitoring and review, as well as the maintenance of specific portfolio-related resources, such as portfolio fact sheets.

The investment philosophy of the committee draws on decades of academic and empirical evidence which, in aggregate, supports the adoption of low cost, well diversified investment strategies that tilt towards sources of higher long term expected returns.

The Consilium series of portfolios seek to outperform standard market returns by utilising the best attributes of active and passive strategies.

* Synergy does not provide tax advice and a tax return may still be required depending on your circumstances

Contact us for more information on Synergy Investments

Vivecca Robinson

Senior Business Growth and Relationship Manager

View profile +